Vijay Kedia Multibagger Stocks : Money is not in buying and selling of shares but in waiting. So, if one is investing in stocks, one must have the longest possible outlook as stock investing with proper planning gives great returns to its investors. The Cera Sanitaryware stock is a living example of Vijay Kedia Multibagger Stocks. The stock has been in a consolidation phase for the past one year, but it is one of the Multibagger stocks that the Indian stock market has produced in recent years. Over the past two decades, this share of Vijay Kedia has risen from ₹10 to ₹4,725 on the BSE, up 47,150 per cent in the same period.

However, the became ex-bonus in September 2010 and the bonus issue was announced in the ratio of 1:1. So, if an investor had invested in this stock 20 years ago and had invested in this stock till date, his actual cost would have been ₹5 per share (double the shareholding due to one bonus share for each share). having) company) instead of ₹10 per. Therefore, due to the issue of 1:1 bonus shares, the actual return would have been 94,300 percent (47,150 x 2).

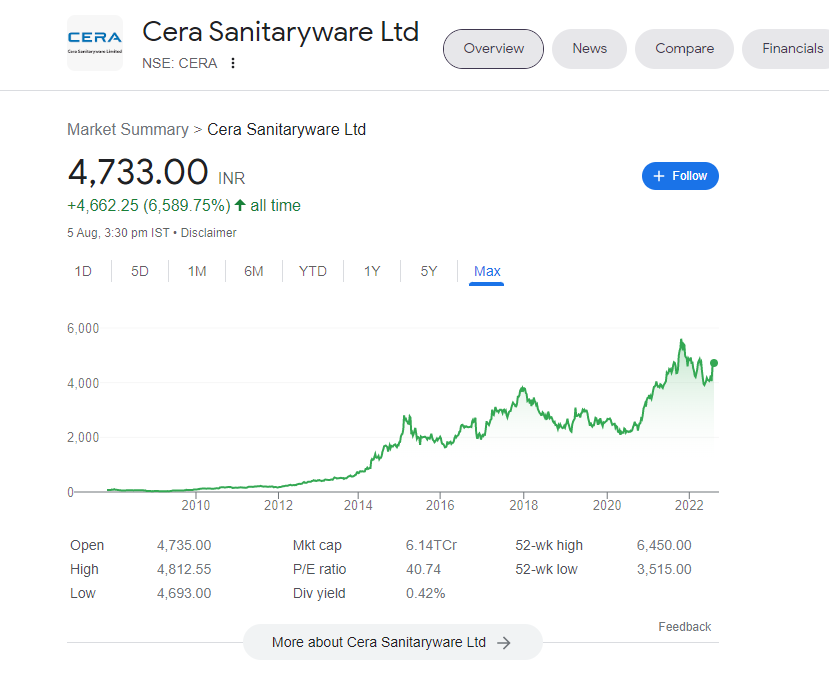

Vijay Kedia Multibagger Stocks: Cera Sanitaryware Share Price History

As mentioned earlier, this stock of Vijay Kedia has been undergoing consolidation for the past one year. It has given a return of just 2 per cent to its shareholders in the last one year, while in the last 5 years, it has grown from around ₹ 2,735 to ₹ 4,725, a growth of nearly 75 percent over the period.

In the last 10 years, it has grown from Share Price ₹300 to ₹4,725 on BSE, providing nearly 1,475 percent return to its shareholders over the past decade. Similarly, in the last 15 years, this multibagger stock has risen from around ₹70 to ₹4,725, registering a growth of around 6,650 percent over the past decade and a half. Similarly, over the past two decades, this multibagger stock has risen from ₹10 to ₹4,725 per level, with a growth of ₹47,150 per cent over the period.

Bonus Share Effect of Vijay Kedia Multibagger Stocks

Since the company announced 1:1 bonus shares in September 2010, a shareholder holding one share received an additional bonus share in return. Therefore, one’s shareholding in the company doubled if he had invested in the company prior to the issue of bonus shares. So, if one had invested in the stock 15 years ago and it has been invested in the scrip during this period, its purchase price will go down to ₹35 per share as the shareholding has doubled due to 1:1 bonus share .

Therefore, its actual return in the last 15 years would be 13,300 per cent. Similarly, if one has invested in the stock 20 years back due to the issue of bonus shares, its actual cost would be ₹5 per share and its actual return over the last two decades would be 94,300 per cent.

Impact on Investment of ₹1 lakh

If an investor had Investment of ₹1 lakh in this stock one year earlier, its ₹1 lakh would have turned to ₹1.02 lakh today whereas it would have turned to ₹1.75 lakh today. Similarly, if an investor had invested ₹1 lakh in this scrip 10 years ago, it would have become ₹15.75 lakh today. Likewise, if an investor had invested ₹1 lakh in this stock 15 years ago, its ₹1 lakh would have turned to ₹1.34 crore.

However, if an investor had invested ₹ 1 lakh in this stock 20 years ago, its ₹ 1 lakh would have turned to ₹ 9.44 crore today.

Shares of this Vijay Kedia portfolio stock are available to trade on both NSE and BSE. But, previously it was available on BSE only. This was made available for trade on NSE in November 2007. Current market cap of the stock is ₹6,144 crore and its trade volume on Friday was 49,547 on NSE. As per the sharing pattern of the company for April to June 2022 quarter, Vijay Kedia holds 1.02 per cent stake in the company.

Hope you liked the above information, follows on the Facebook page to know new tips.

Like us on MahaNeo.Com – Facebook